However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. You can find the balance sheet on a company’s 10-K filing, which is required by the US Securities and Exchange Commission (SEC) for all publicly traded companies. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. The cash ratio compares the cash and other liquid assets of a company to its current liability.

Why are D/E ratios so high in the banking sector?

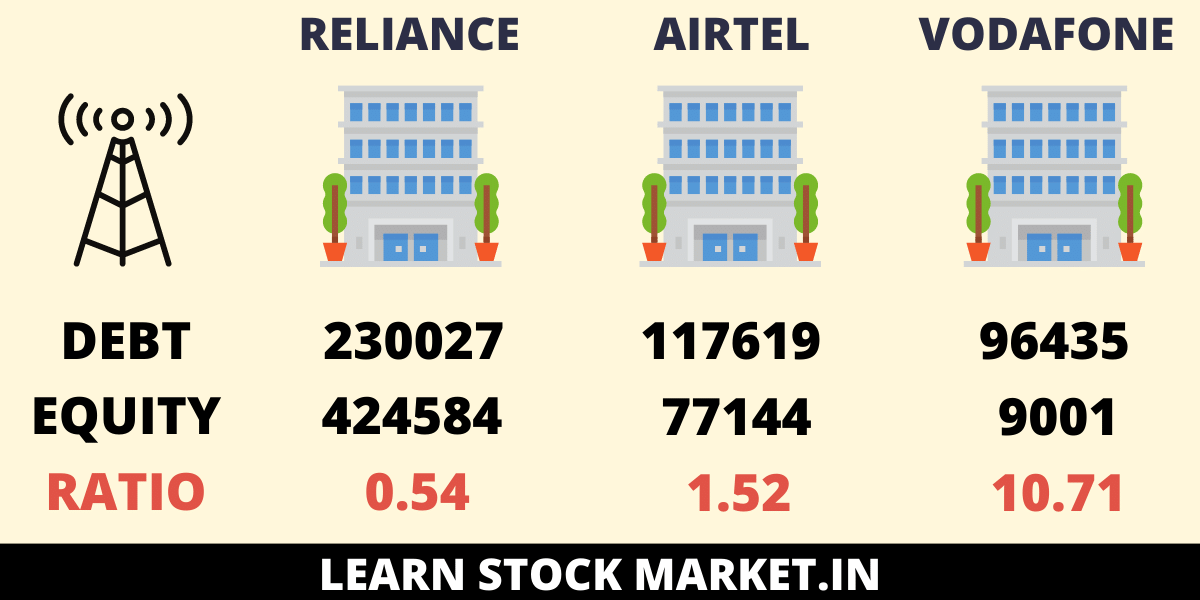

Companies with a higher debt to equity ratio are considered more risky to creditors and investors than companies with a lower ratio. Since debt financing also requires debt servicing or regular interest payments, debt can be a far more expensive form of financing than equity financing. Companies leveraging large amounts of debt might not be able to make the payments. Debt-to-equity is a gearing ratio comparing a company’s liabilities to its shareholder equity. Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits.

What Is Considered a High Debt-To-Equity (D/E) Ratio?

They can also issue equity to raise capital and reduce their debt obligations. The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations. This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations. When it comes to choosing whether to finance operations via debt or equity, there are various tradeoffs businesses must make, and managers will choose between the two to achieve the optimal capital structure. Although debt financing is generally a cheaper way to finance a company’s operations, there comes a tipping point where equity financing becomes a cheaper and more attractive option. A higher D/E ratio means that the company has been aggressive in its growth and is using more debt financing than equity financing.

How confident are you in your long term financial plan?

In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios. Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk. The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. The interest rates on business loans can be relatively low, and are tax deductible. That makes debt an attractive way to fund business, especially compared to the potential returns from the stock market, which can be volatile.

Debt-to-equity ratio of 0.25 calculated using formula 2 in the above example means that the company utilizes long-term debts equal to 25% of equity as a source of long-term finance. Let’s look at a real-life example of one of the leading tech companies by market cap, Apple, to find out its D/E ratio. Looking at the balance sheet for the 2023 fiscal year, Apple had total liabilities of $290 billion and total shareholders’ equity of $62 billion. While the D/E ratio is primarily used for businesses, the concept can also be applied to personal finance to assess your own financial leverage, especially when considering loans like a mortgage or car loan. It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good. Additionally, the ratio should be analyzed with other financial metrics and qualitative factors to get a comprehensive view of the company’s financial health.

How to Calculate the Debt-to-Equity Ratio

- Increase revenue and use the new equity to either buy new assets or pay off existing debts.

- A higher ratio suggests that a company is more reliant on debt, which may increase the risk of insolvency during periods of economic downturn.

- As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0.

Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders. This ratio helps indicate whether a company has the ability to make interest payments on its debt, dividing earnings before interest and taxes (EBIT) by total interest. Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement. To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18. The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns.

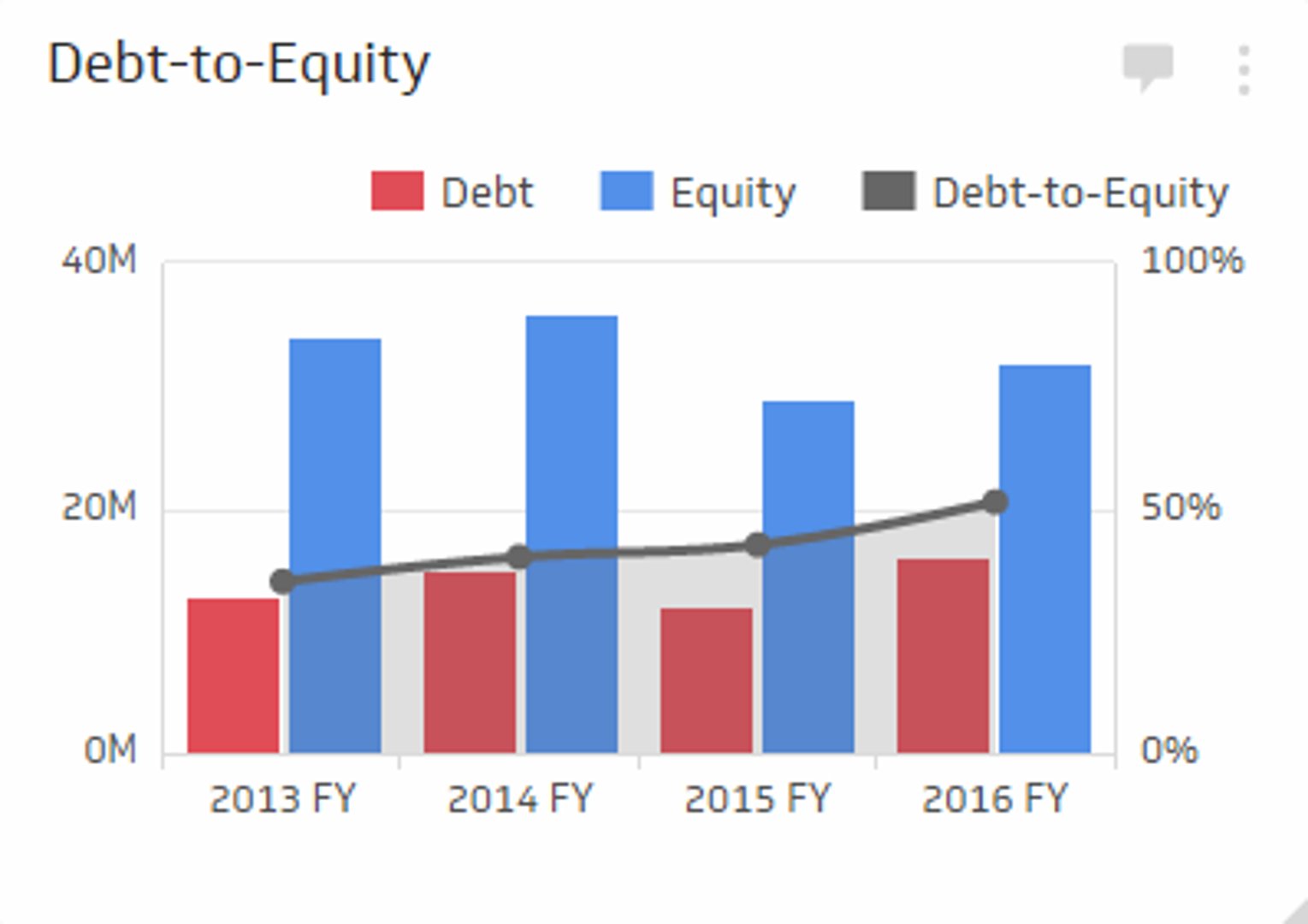

As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations. In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities.

In some cases, creditors limit the debt-to-equity ratio a company can have as part of their lending agreement. Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect. Not only that, companies with a high debt-to-equity ratio may have a hard time working with other lenders, partners, or even suppliers, who may introducing xeros new app marketplace be afraid they won’t be paid back. As noted above, it’s also important to know which type of liabilities you’re concerned about — longer-term debt vs. short-term debt — so that you plug the right numbers into the formula. Increase revenue and use the new equity to either buy new assets or pay off existing debts. Debt-to-equity ratio directly affects the financial risk of an organization.

“Some industries are more stable, though, and can comfortably handle more debt than others can,” says Johnson. D/E ratios vary by industry and can be misleading if used alone to assess a company’s financial health. For this reason, using the D/E ratio, alongside other ratios and financial information, is key to getting the full picture of a firm’s leverage. The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile.

The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. A lower debt to equity ratio usually implies a more financially stable business.