If the sale and purchase of assets have been properly recorded, that makes it easier to see the asset classifications you need to report on the balance sheet. Expenses and losses are debited because they decrease the company’s equity. Income and gains are credited because they increase the company’s equity.

Does your accounting method influence your accounts?

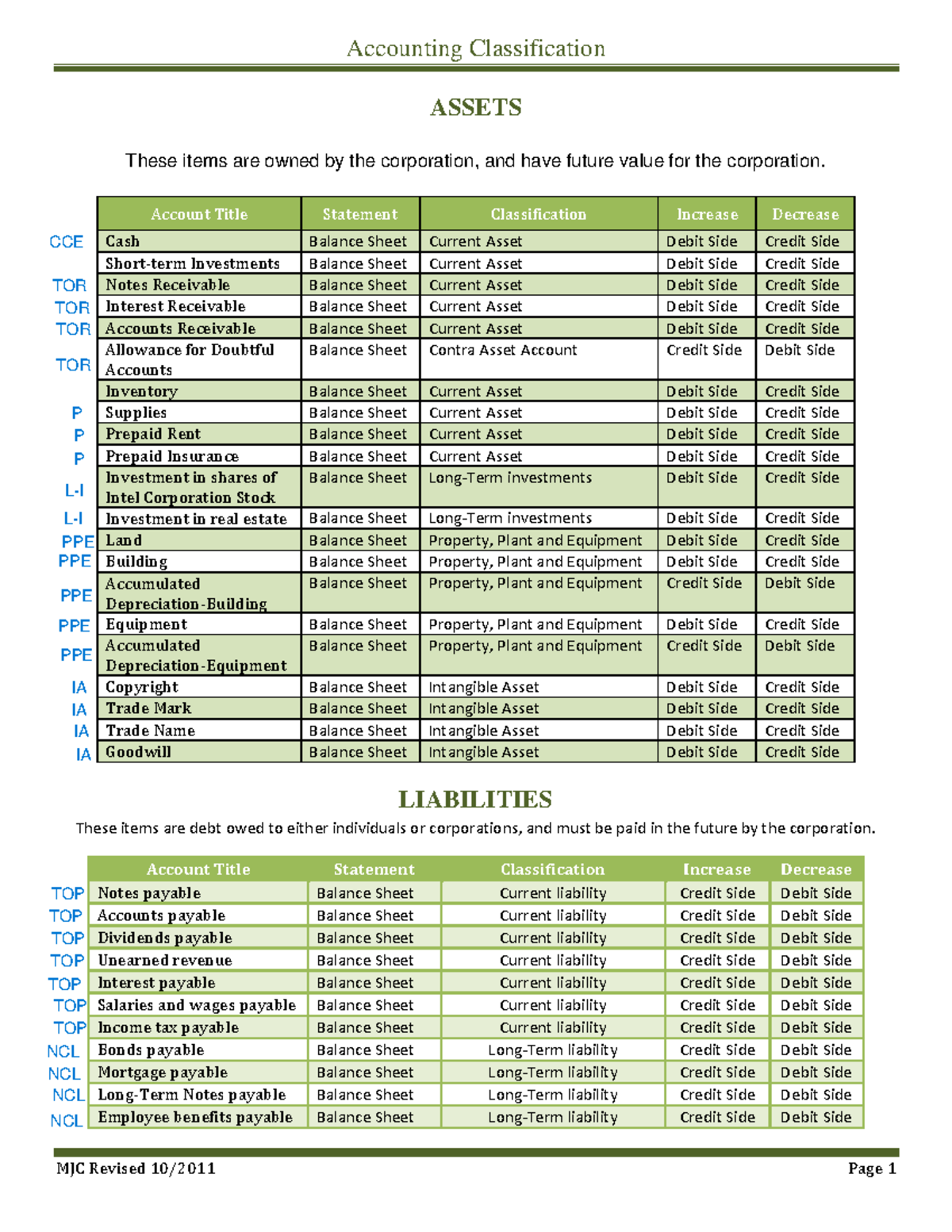

These current liabilities are those debts that must be paid within one year or within the normal operating cycle of the business. On the other hand, long term liabilities include long-term debt and other debts that are due in more than 12 months. The chart of accounts is a key part of converting ledgers into financial statements. The chart is a list of all the accounts used in the general ledger, identifying each account by number. Your accounting software uses the chart to identify the accounts such as revenue, common stock, cash and depreciation that must be included in making up the balance sheet. The simplest way to record transactions is to write them into an accounting journal, adjusting different account classifications accordingly.

The 5 Types of Accounts in Financial Accounting

Generally, businesses list their accounts by creating a chart of accounts (COA). A chart of accounts lets you organize your account types, number each account, and easily locate transaction information. Representative personal account represents a group of account. Assets are regarded as the economic resources that a company has, liabilities represent creditors’ claims on these resources, while owners’ equity is the residual claim on the resources.

- In the preparation of the above, financial accounting uses a bunch of accounting principles.

- These are all done following the statistical processes to make a final financial-accounting report of the company.

- MSMEs may not comply with paragraphs 22 (c),(e) and (f); 25 (a), (b) and (e); 37 (a), (f) and (g); 38; and 46 (b), (d) and (e) relating to disclosures.

- Hence, we record all the transactions related to a particular item in its account.

- The software then automatically debits or credits the appropriate account classifications.

What about business revenues and expenses?

The golden rules are dependent on the accurate classification of the account. In the preparation of the above, financial accounting uses a bunch of accounting principles. These contain different rules and assumption set out for the preparation of financial statements. When someone receives something from the company, their account is debited. When someone gives something to the company, their account is credited. A Liability account refers to the money you owe to other parties, such as vendors, suppliers, utility providers, and more.

Relationship Between Financial Statement Elements and Accounts

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website.

Real, Personal and Nominal Accounts

What’s more, it’s the difference between the separate accounts of your assets and liabilities. The main types of accounts used under this approach are mostly best law firm accounting software in 2023 self-explanatory. Provided that such a partial exemption or relaxation and disclosure shall not be permitted to mislead users of financial statements.

Second among three types of accounts are personal accounts which are related to individuals, firms, companies, etc. A few examples are debtors, creditors, banks, outstanding accounts, prepaid accounts, accounts of customers, accounts of goods suppliers, capital, drawings, etc. Businesses that record only cash transactions don’t need a cash flow statement.

For example, all-cash transactions whether receipts or payments will be recorded in the Cash A/c. Real accounts exist even after the end of accounting period. For the next accounting period, these accounts start with a non-zero balance, which is carried forward from the previous accounting period. Personal accounts are the accounts that are used to record transactions relating to individual persons, firms, companies, or other organizations.